Food Coating Market Size to Hit USD 11.69 Billion by 2034 | Towards FnB

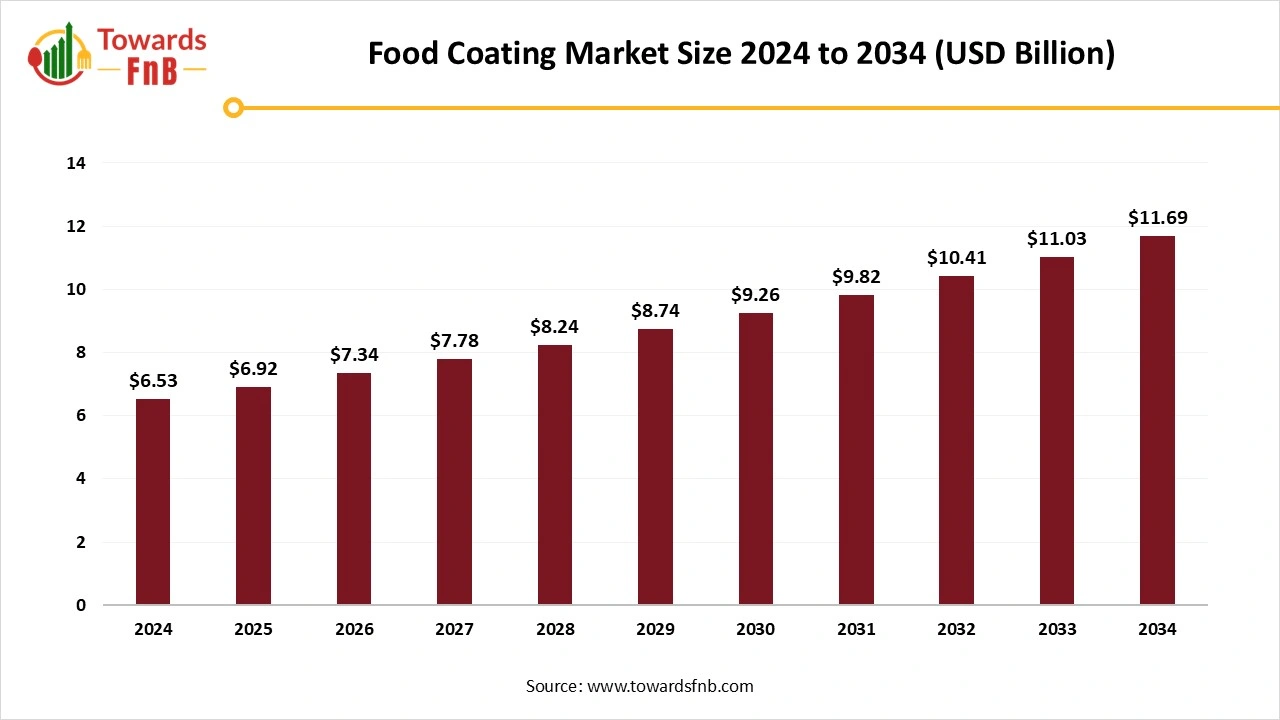

According to Towards FnB, the global food coating market size is evaluated at USD 6.92 billion in 2025 and is anticipated to surge USD 11.69 billion by 2034, reflecting at a CAGR of 6% from 2025 to 2034. This long-term expansion reflects the industry’s shift toward value-added coatings that improve product performance, extend shelf life, and support the rising demand for innovative food formats across both retail and foodservice sectors.

Ottawa, Nov. 14, 2025 (GLOBE NEWSWIRE) -- The global food coating market size stood at USD 6.53 billion in 2024 and is predicted to increase from USD 6.92 billion in 2025 to reach around USD 11.69 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research. This growth is driven not only by high-volume consumption categories like snacks, meat, and bakery but also by manufacturers adopting cleaner labels, advanced coating technologies, and AI-led formulation tools to enhance product differentiation.

The surge in demand is strongly tied to evolving consumer habits, especially the preference for convenient, portable, and ready-to-eat foods that fit busy lifestyles. Beyond convenience, shoppers increasingly look for foods with improved taste, texture, visual appeal, and nutritional balance, prompting brands to experiment with specialty coatings, low-oil absorption systems, and plant-based alternatives. As a result, food coatings have become essential in delivering the sensory quality, crispiness, and freshness that today’s consumers expect whether at home, on-the-go, or through delivery platforms.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5914

Key Highlights of the Food Coating Market

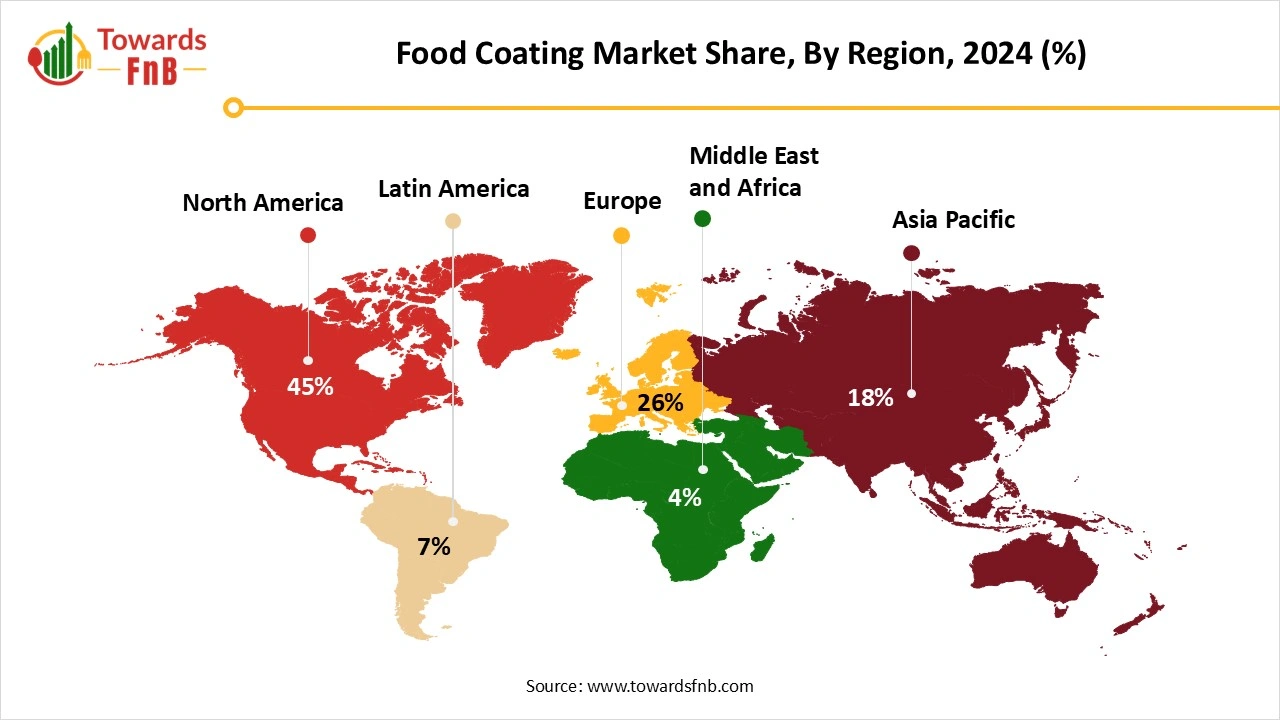

- By region, North America led the global food coating market with a highest share of 45% in 2024, while the Asia Pacific region is anticipated to grow at a notable CAGR of 7.5% from 2025 to 2034.

- By type, the batter coatings segment held the dominant market share of 56.8% in 2024, whereas the specialty coatings segment is projected to expand at a CAGR of 6.8% between 2025 and 2034.

- By ingredient type, the batter mixes segment led the market with a share of 32.4% in 2024, while the seasonings & spices segment is expected to grow at a significant CAGR of 6.7% from 2025 to 2034.

- By application, the meat & poultry segment held the largest share of 36.5% in 2024, while the snacks segment is expected to experience significant growth at a CAGR of 6.5% over the forecast period.

- By end use, the processed food industry dominated the market with a 62.5% share in 2024, while the Foodservice / HORECA segment is expected to grow at a CAGR of 6.8% from 2025 to 2034.

Higher Demand for Convenient and Plant-Based Options is helpful for the Food Coating Industry Growth

The food coating market is expected to grow due to factors such as the higher demand for convenient, processed, and healthier food options, as well as for natural food coatings. Higher demand for convenience food options and snacks, especially among consumers with hectic lifestyles, also helps fuel market growth. Higher consumer demand for healthier, plant-based options to maintain nutritional profiles also helps fuel market growth. Different types of food coatings help maintain the shelf life of various food options, enhance their flavors and textures, and support market growth.

Impact of AI in the Food Coating Market

Artificial intelligence is becoming an important technological driver in the food coatings market by improving formulation efficiency, quality control and production accuracy. AI tools help manufacturers analyse ingredient behaviour, predict coating performance and optimise the choice of lipids, proteins, polysaccharides, or emulsifiers used in edible coating systems. This allows companies to design coatings with better moisture barriers, improved texture retention and longer shelf life for fruits, vegetables, bakery product and ready-to-eat snacks.

Machine-learning models support faster development of coating formulations by simulating how different ingredient combinations behave under temperature, humidity and handling conditions. This reduces the number of physical trials, lowers R&D costs and shortens the time required to scale new coating technologies. AI-enabled process control is also being integrated into coating lines, where sensors monitor viscosity, coating thickness and drying behaviour in real time, helping maintain consistent product quality.

Recent Developments in Food Coating Market

- In June 2025, Akorn Technology launched a sustainable and edible coating for cucumbers, which is revolutionary for the cucumber packing, distribution, and selling industry, according to the brand. The edible coating will help to replace single-use plastic wraps. (Source- https://www.fruitnet.com)

- In April 2025, McCain Foods, a world leader in prepared potatoes, launched its new product- McCain SureCrisp Max. The brand states that the product will last for up to 30 minutes, making it ideal for dine-in, takeaway, and delivery, with exceptional taste, texture, and crispiness. (Source- https://vir.com.vn)

New Trends of the Food Coating Market

- Higher demand for natural, clean-label, and healthier food options with natural coatings helps to enhance the growth of the market.

- Various technological innovations that help to lower oil absorption are another major factor for the growth of the market.

- Higher demand for convenient and healthier snack options available in flavorful and organic coatings also helps to enhance the growth of the market.

- Coatings available in low-fat, low-oil-absorption, and gluten-free options also help enhance market growth.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/food-coating-market

Technological Innovations are helpful for Market’s Growth

Various technological innovations, such as nanotechnology, composite coatings, electrostatic coating, spray drying, and others, help enhance the growth of the food coating market. Such technological innovations help enhance the shelf life of various food options, such as frozen snacks, meat and poultry, and other vegetable snacks. Such innovative options also help enhance food safety, deliver active ingredients, improve barrier properties, and support sustainability.

Trade Analysis for the Food Coating Market

Typical Exporter and Importer Profiles

- Exporters tend to be countries with strong chemical, food ingredient, or biotech manufacturing capacity that can supply polymers, proteins, lipids, and functional additives used in coatings. Importers are often food-processing hubs and countries with large fresh produce trade where shelf-life extension is critical. Trade visualisations for HS 3507 also list Denmark, the United States and China among the top suppliers by value in 2023. Top importers for related proteins and enzymes include the United States and large food manufacturing markets in Europe and East Asia.

Trade Policy and Regulatory Drivers

- Sanitary and phytosanitary rules, food contact material regulations, and chemical safety requirements strongly affect trade flows. Exporters need to meet the food contact material standards and labelling rules of importing jurisdictions to secure market access. FAO and national food safety agencies provide guidance that affects allowable ingredients and, therefore, trade patterns.

Logistics, Cold Chain, and Product Form Considerations

- Many edible coatings are shipped as concentrates, powders, or dry film-forming ingredients rather than finished wet coatings. This affects freight, customs classification, and shelf-life logistics. For 2023, WITS/UN Comtrade summaries show that the European Union reported exports under HS 3507 totalling about USD 2.16 billion, while the United States reported roughly USD 1.56 billion. These magnitudes indicate substantial cross-border trade in protein and enzyme products that can serve edible coating and formulation needs.

Research and Patent Flows As Trade Indicators

- Patent filings, scientific publications, and technology transfers are useful leading indicators of where production capacity and export capability are likely to emerge. Scientific reviews document the rapid development of edible films and coatings and their rising adoption to reduce postharvest losses and extend shelf life for fruit, vegetables, and fresh-cut produce. Bibliometric analyses show a concentration of research activity on edible coatings in regions such as Europe, North America, and parts of Asia, which helps predict future export capacity.

Product Survey — Global Food Coating Market

| Product Category | Description / Function | Common Ingredients / Coating Types | Key Applications / End-Use Sectors | Representative Producers / Brands |

| Batter Coatings | Wet mixtures form the first adhesion layer on foods before breading/frying. | Wheat flour, starches, proteins, spices, and leavening agents | Fried chicken, fish fillets, nuggets, and onion rings | Kerry Group, Newly Weds Foods, Pinnacle Foods Group |

| Breadings (Dry Coatings) | Dry crumb-based coatings provide crunch and texture after frying or baking. | Bread crumbs, panko, cereal flakes, corn flour, seasonings | Poultry, seafood, appetizers, plant-based nuggets | Newly Weds Foods, Bunge, Cargill, Blendex |

| Predust Coatings | Light, dry layer improving batter adhesion and moisture retention. | Corn starch, wheat flour, dextrins, proteins | Meat, seafood, and vegetables before battering | Ingredion, Archer Daniels Midland (ADM), Solina |

| Flour-Based Coatings | Simple coatings used for light frying and sautéing to enhance crispness and color. | Wheat flour, rice flour, potato flour, spices | Chicken strips, vegetables, fish | Cargill, Griffith Foods, Associated British Foods |

| Tempura Coatings | Specialty batters yield puffy, airy crusts. | Rice flour, wheat flour, starches, and leavening agents | Japanese-style fried foods, shrimp, and vegetables | Kerry Group, Newly Weds Foods, Ajinomoto |

| Glazes & Sauce Coatings | Liquid coatings provide shine, flavor, and moisture retention. | Sugar syrups, starch-based glazes, butter/oil coatings | Bakery goods, frozen foods, ready meals | Dawn Foods, Puratos, CSM Ingredients |

| Seasoning & Marinade Coatings | Flavoring systems that enhance taste, color, and preservation. | Spices, herbs, marinades, dry rubs, natural flavors | Meat, snacks, ready-to-eat foods, plant-based foods | Griffith Foods, Solina Group, Kerry |

| Functional Coatings (Health-Oriented) | Coatings offering added nutritional benefits or clean-label functionality. | Fiber coatings, protein-rich coatings, and natural antimicrobials | Baked snacks, fortified fried foods, and low-fat products | Tate & Lyle, Ingredion, BENEO |

| Enrobing Coatings (Sweet Applications) | Chocolate or compound coatings are used for confectionery and bakery products. | Chocolate, cocoa compounds, yogurt coatings, caramel | Bars, cookies, cereals, ice creams | Barry Callebaut, Blommer, Puratos, Cargill |

| Oil & Fat-Based Coatings | Coatings providing shine, moisture barrier, and enhanced mouthfeel. | Vegetable oils, shortening, cocoa butter alternatives | Popcorn, nuts, snack foods | AAK, Bunge, Cargill |

| Edible Coatings for Fresh Produce | Thin films prevent moisture loss and extend shelf life. | Polysaccharides, proteins, waxes, and essential oils | Fruits, vegetables, and minimally processed foods | Apeel Sciences, Mantrose-Haeuser, AgroFresh |

| Coatings for Plant-Based & Alternative Proteins | Tailored coatings to improve the texture and browning of plant-based meats. | Gluten-free batters, pea-protein batters, natural fibers | Plant-based nuggets, fillets, patties | Kerry, Newly Weds Foods, Ingredion |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5914

Food Coating Market Dynamics

What are the Growth Drivers of Food Coating Market?

Higher demand for convenient, healthier snacks and plant-based food options is a major factor driving market growth. Food coatings help to maintain the flavors, texture, and shelf life of such food options. Such coatings also enhance the texture of meat, poultry, and frozen snacks, further fueling market growth.

Coated food options, along with appealing flavors and textures, also have attractive looks, which help lure customers to buy them. Hence, such factors are vital to fuel the market's growth. Technological advancements and advanced machinery used to form batter for food coatings and evenly spread it on various food options also help enhance market growth.

Challenge

Market and Supply Chain Issues hampering the Market’s Growth

Disruptions in the supply of raw materials, such as flour, oils, and starches, required for making different types of food coatings, can be a constraint on market growth. Such disruptions can be caused by various factors, such as climate issues, geopolitical issues, and production costs. Issues in sourcing other essential ingredients, such as emulsifiers and stabilizers, are another factor delaying market growth.

Opportunity

Innovative Food Coatings are helpful for the Market’s Growth

Different types of innovative and functional food coatings represent a major opportunity for market growth. They help to enhance the flavors and textures of various food options. Functional food coatings help protect various food options and enhance their shelf life, which supports market growth. Such food coatings are further refined to premium quality with advanced technology and equipment for even coating application.

Food Coating Market Regional Analysis

North America led the Food Coating Market in 2024

North America led the food coating market in 2024 due to higher demand for convenient, healthier, plant-based, and coated food options. Food coatings help maintain the flavor, texture, and shelf life of snacks, seafood, meat, and poultry products, which are highly demanded by consumers of all ages. Such factors help enhance market growth in the region. Advanced technology helps enhance the quality of food coating, and the equipment used in the food coating technique also supports market growth. The US makes a major contribution to market growth due to higher demand for processed, coated, and convenient food options.

Asia Pacific is observed to grow at a Notable Rate in the Forecasted Period

Asia Pacific is expected to grow at a notable pace over the forecast period, driven by the expansion of Quick Service Restaurants (QSR) chains and various types of food outlets. Such outlets are popular among millennials and Gen Z, further enhancing the market’s growth. Countries such as India, China, and Japan have a major contribution in the growth of the market in the region due to growing QSRs and food outlets in the region serving convenient food options, snacks, healthier, and plant-based food options, along with coated food options, which are helpful for the growth of the market.

Food Coating Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Market Size in 2025 | USD 6.92 Billion |

| Market Size in 2026 | USD 7.34 Billion |

| Market Size by 2034 | USD 11.69 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Food Coating Market Segmental Analysis

Type Analysis

The batter coatings segment dominated the food coating market in 2024 due to growing demand for convenient food options and snacks. Such options are easy to consume and carry, helpful for consumers with hectic lifestyles. Higher demand for plant-based and healthier alternatives is another major factor driving market growth. Maintaining moisture, crunchiness, and a healthy nutritional profile is a major factor in the segment's growth, which supports the market’s growth. Product innovation helps maintain the texture and appearance of convenient food options without compromising their nutritional levels, which also supports market growth.

The specialty coating segment is expected to grow in the foreseeable period due to higher demand for convenient and healthier food options. Such coatings help to maintain the nutritional levels, crunchiness, and moisture content of food. It helps maintain the appearance, taste, and texture of various food options, further fueling market growth. Specialized coatings are essential for fragile foods such as frozen, lightly processed, and snack food.

Ingredient Type Analysis

The batter mixes segment led the food coating market in 2024 due to higher demand for such premixes as they help to save time and provide an ideal layer to vegetables, seafood, and other food options while frying. Such batters have the right amount of water and other liquids mixed in them for that apt flavor while frying. Such premixes also help save time in commercial and household kitchens, further fueling market growth. Such batters can also be used for baking and other cooking techniques, enhancing the growth of the market.

The seasonings and spices segment is expected to grow in the foreseen period due to high demand for a variety of flavor options in a single food product. Different, unique, and attractive flavor profiles, international flavor profiles, and globalization are among the major factors driving the segment's growth, further fueling the market's growth in the foreseeable period. Higher demand for convenient and clean-label food options with a distinctive flavor profile is another major factor for the growth of the market.

Application Analysis

The meat and poultry segment led the food coating market in 2024 due to higher demand for meat and poultry in convenient, snack options, and frozen options. An ideal food coating helps to enhance the taste, texture, and crunchiness of such food items. The food coating helps to maintain the nutritional value, moisture, and crunchiness of various food options, further fueling the growth of the market.

The snacks segment is observed to be the fastest growing in the foreseen period due to higher demand for a variety of snacks such as convenient, easy to carry, plant-based, and healthier options. When such snacks are coated in batter, it helps to enhance the flavor, taste, texture, and crunchiness, further fueling the growth of the market. Different types of snack options, such as nuts, seeds, and savory snacks coated with various batters and glazes, further fuel the market's growth.

End Use Analysis

The processed food industry dominated the food coating market in 2024 due to higher demand for convenient food options and snacks. Food coatings help to enhance the taste, texture, shelf life, and nutritional value of such food options, further fueling the growth of the market. Food coatings are also highly demanded for healthier, plant-based food options to maintain their taste and texture, which is helping drive market growth. Improving food technology and machinery used for applying batter to different types of foods evenly is also a major factor for the growth of the market.

The foodservice segment is expected to grow in the foreseeable period due to high demand for convenient and snack food options. Such food options coated in different types of flavorful batters are highly demanded in the food service segment, further fueling the growth of the market. Such coatings help to enhance the flavors, texture, and shelf life of various food items, further fueling the growth of the market in the foreseen period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Food Coating Market

- Kerry Group plc – Kerry supplies a broad portfolio of food coating systems, including batters, breadings, glazes, and marinades, designed to enhance texture, taste, and visual appeal. The company focuses on clean-label, functional, and customizable coating solutions for meat, seafood, snacks, and plant-based products.

- Cargill, Incorporated – Cargill provides starches, proteins, seasonings, and specialty ingredients used in dry and wet coating systems. Its solutions improve adhesion, crispiness, moisture control, and flavor delivery for processed foods and fried applications.

- Tate & Lyle PLC – Tate & Lyle offers functional starches, texturizers, and sweetener-based ingredients used in coating formulations. The company supports improved crunch, reduced oil uptake, and stable coating performance across baked and fried products.

- Ingredion Incorporated – Ingredion supplies modified starches, plant proteins, hydrocolloids, and texturizing systems used in food coatings. Its ingredients enhance binding, crispness, and structure while supporting clean label and gluten-free options.

- Newly Weds Foods, Inc. – Newly Weds Foods is a major producer of batters, breadings, seasoning blends, and coating systems for meat, poultry, seafood, and snacks. The company specializes in custom-formulated coatings with global flavor profiles.

- Bowman Ingredients – Bowman manufactures breadings, batters, gluten-free coatings, and value-added crumb systems for frozen and prepared foods. Its solutions emphasize consistent texture, adhesion, and performance in industrial processing.

- Solina Group – Solina develops savory coatings, marinades, seasoning blends, and functional coating solutions for meat, poultry, seafood, and plant-based applications. The company focuses on flavor innovation and tailored formulation.

- PGP International, Inc. – PGP International produces extruded crisps, rice-based ingredients, and textured particles used as crunchy inclusions or coating components. Its products support improved texture and nutritional profiles.

- GEA Group AG – GEA provides processing equipment for coating applications, including batter mixers, breading machines, and coating lines used in industrial food manufacturing. Its systems enhance efficiency, consistency, and product quality.

- Marel hf. – Marel supplies automated coating equipment and integrated processing lines for meat, poultry, and seafood. Its technologies improve coating uniformity, reduce waste, and support high-volume production.

- JBT Corporation – JBT designs coating and processing machinery such as batter applicators, breading machines, and fryer systems. The company focuses on optimizing coating adhesion, throughput, and product yield.

- McCormick & Company, Inc. – McCormick offers seasoning blends, marinades, and flavor coatings used in snacks, poultry, seafood, and prepared foods. The company specializes in flavor-forward coating solutions with global taste profiles.

- Bühler AG – Bühler supplies coating and processing technologies for snacks, cereals, and specialty foods, including enrobing and seasoning systems. Its equipment supports precision application and uniformity.

- Dutch Protein & Services B.V. – The company provides specialty proteins, coating mixes, and functional ingredients for meat, seafood, and vegetarian products. Its solutions focus on binding, crisping, and textural enhancement.

Segment Covered in the Report

By Type

- Batter Coatings

- Breading Coatings

- Flour Coatings

- Specialty Coatings (glazes, tempura, crumbs, etc.)

By Ingredient Type

- Flours

- Batter Mixes

- Crumbs & Flakes

- Starches

- Proteins

- Seasonings & Spices

- Oils & Fats

By Application

- Meat & Poultry

- Seafood

- Snacks

- Bakery Products

- Confectionery

- Fruits & Vegetables

By End-Use

- Processed Food Industry

- Bakery & Confectionery Industry

- Foodservice / HORECA

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5914

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.